As an employer, you have specific payroll responsibilities that are required by government agencies. These agencies can be federal, state or local. Some of these responsibilities include, but are not limited to, withholding amounts from your employees’ compensation to cover income tax, social security, medicare, and other payments.

Payroll management can be subdivided into two sub processes, i.e. Payroll accounting and Payroll administration.

Payroll Accounting

Payroll Accounting

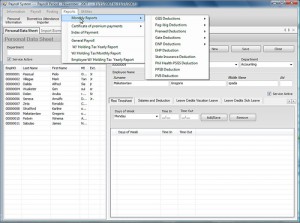

It involves calculations of employees’ salaries and tax deductions. It also undertakes the activities such as preparation of tax returns, maintaining the payroll records, etc.

Payroll Administration

It involves managerial activities such as maintaining employees’ records, referring employment laws. Here, the HR dept. comes into picture which maintained the daily record of employees’ attendance.

Your payroll records must be kept for three years from the date of the last entry you made on them. This includes “supplementary records, including basic employment and earnings records; wage rate tables; order, shipping, and billing records; and records of additions to or deductions from wages paid.” Some states require that certain records be kept for more than three years.

You can also choose to outsource this service. Opting to do it yourself, you can process payroll either manually or with a payroll software program. Any system you choose or design yourself, must be able to calculate all employee payroll obligations, payroll deductions and payroll tax

obligations, as well as record and update all payroll information in a general ledger. You would file payroll taxes yourself in such a case. The taxes you are required to deduct from the checks of full or part-time employees vary by state.